It’s become an all too familiar storyline — the City of Turlock is once again looking for a way to shore up its diminishing reserves and bridge the gap between revenues and expenses. But this time around, the City has the added impact of significant drops in sales tax and other revenues due to the coronavirus pandemic and the resulting economic shutdown.

The Turlock City Council spent some time on Tuesday going over a forecasted 2019-20 fiscal year end budget, while trying to decide on a path forward for the next fiscal year in the midst of economic uncertainty.

The Council adopted a budget for 2019-20 that saw a drastic tightening of the City’s financial belt and significantly impacted what services are provided to Turlock residents. Last year’s budget defunded 16 vacant positions and cut public safety overtime budgets, allowing for fewer police officers and firefighters on duty on a weekly basis.

When it was adopted, City department heads said the cuts wouldn’t be sustainable as safety equipment would eventually need to be replaced and public safety staffing wasn’t optimal for a city as large as Turlock.

“It’s no secret that the City has faced significant financial challenges in the past several years. This year…in through February the City was doing a fantastic job of managing a budget. The staff that I’m looking at and the rest of the team have done an outstanding job of managing the Fiscal Year ‘19-20 budget that, if not for COVID, would be in a really, really good position. The revenues were up, expenditures were down and it was tracking in a very good position through February, before the whole world changed on us,” said City Manager Toby Wells at the May 13 budget workshop.

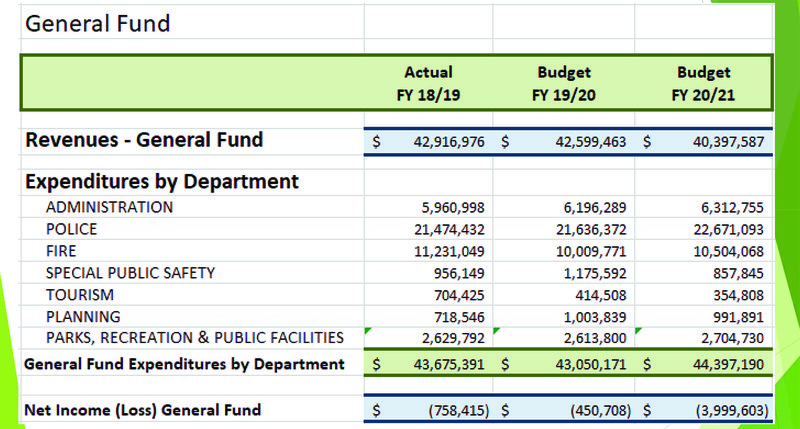

The City is expecting a $775,000 carryover in salary savings from the 2019-20 year ending, due to the number of vacancies. But that won’t be enough to bridge the gap of an expected $4 million deficit in the coming fiscal year that includes a drop of $1.8 million in revenues and increased expenses, with the majority of those increases ($1.4 million) coming from employee salaries and benefits.

The $4 million shortfall does not include unfunded PERS (employee retirement fund) liabilities, funds that need to be repaid to the assessment districts and a deficit balance from the Engineering Department that was left unchecked for a decade.

While the City is hoping to get an injection of cannabis development agreement funds before the end of 2020, it won’t be enough to make a difference in the coming budget cycle.

In February, the City Council received the results of a poll commissioned to gauge support for a city sales tax measure. The poll, conducted Feb. 3 through 9 — one month before the beginning of shelter in place health orders in response to the coronavirus — found that a majority of Turlock residents would support a 1 cent sales tax increase to help fund City services.

On Wednesday, the City Council held a special meeting to decide if it wanted to move forward with a sales tax measure for the November ballot.

Assistant to the City Manager for Economic Development and Housing Maryn Pitt said that she participated in a webinar hosted by the polling firm and sales tax consultants the City has partnered with and learned that early trends point to continued support for tax measures in most communities. However, the consultants found that support may be more fluid in lower income communities that have experienced more economic impacts from the virus and the impacts on the pandemic related to tax measures is still a moving target.

Support for a Turlock sales tax measure was mixed in the public comments given during Wednesday’s special meeting.

“Please put a one-half cent sales tax measure on the ballot and let the citizens of Turlock make the decision. A one-half cent sales tax will not have a negative impact on any citizen, store owner or business in Turlock. Our city will still have a sales tax rate that is average for the Valley. This tax will generate about $6.5 million a year for the City. We can’t keep asking our city police, fire, parks and rec departments to keep cutting personnel and doing more work with less people,” said Milt Treiweiler.

Local attorney Mike Warda said that a City sales tax would send people out of town for large purchases, like cars and trucks.

“We are in dire straits, there’s no doubt about it, but taxing businesses further or taxing people further is not the solution to this. We need to figure out ways to help all these businesses get open, stay open, figure out a way to get around whatever the governor is doing,” said Warda.

Detective Tim Redd with the Turlock Associated Police Officers union urged the Council to follow the city manager’s recommendation to put something on the ballot.

“I understand there’s been people calling in for and against, but in reality we have almost 70,000 people in this city alone and to actually field those calls tonight might give you the pulse whether it’s going to pass or not…I think it’s very important for the public to understand that this is not a tax to give us fatter salaries or take care of healthcare issues as I’ve seen the propaganda out on social media sites lately, it’s about bringing services back,” said Redd.

“If we don’t pass some kind of tax measure, we’re going to start losing officers and eventually, I hate to see it happen, but we could all very well be wearing tan and green (of the sheriff’s department) and we would not get anywhere near the service level the community enjoys at this moment, even with the dire straits with COVID and everything else. You’re not going to see the same service level being patrolled by another agency that you do now,” he continued.

Turlock resident Robert Puffer said the unions will have to make sacrifices.

“I don’t think a one cent sales tax will have much chance of passing unless you get your house in order first and that means PERS and healthcare. The union is going to have to realize this is not 1980 anymore…Private industry is already transitioning, individuals are paying much more or all of their healthcare and retirement and public unions are going to have to get your constituents to realize they are going to have to become responsible for the majority of their healthcare and retirement,” said Puffer.

Turlock resident Teri Shaver was in support of a tax measure, at the one percent rate.

“It has been clear for a long time that declining reserves must be made up by creating another source of revenue. A sales tax adjustment is the most obvious solution. The question is the amount of the percentage…. It’s going to be necessary to get the amount just right. Ask for too little and we’ll be asking again in few years. One-half cent may be palatable and a good compromise in order to get it passed, however, one percent is the amount that will most quickly bring us the much-needed revenue support and will hold us steadily restore services and help keep us above board,” said Shaver.

Former Turlock Mayor Brad Bates wanted to know what the Council’s plan was without any additional revenue sources.

“Just two scenarios: Scenario ‘A,’ you choose not to put a tax on the ballot; or scenario ‘B,’ you put the tax initiative on the ballot and it fails. In either one of those scenarios, will the Council have a plan of action if a tax either isn’t on the ballot or it fails?” asked Bates.

The majority of the City Council agreed that a new source of revenue was needed and a sales tax measure was the best way forward at this time.

“Anybody can say we need to find ways to increase the revenue, yet nobody’s really shown us a way, a method of doing that. Do I like paying taxes? No, I don’t. But do I want our service levels to go back to the way they were or better? Yes, I do,” said Council member Gil Esquer.

“No one gets elected to try and pass a tax. We know that no one wants additional expenses in their life. The cost of living is going up every year and the thought of adding it (sales tax measure) is going to be met with resistance in the community, but I’m just looking at the fiscal reality we are facing and without new sources of revenue, we are going to see continued diminishing of services that’s going to result in less presence from the police and higher risks on the public safety standpoint. That’s the kind of thing that scares me as a resident and a Council member. You’re looking at a Turlock that’s not necessarily desirable to live in anymore,” said Vice Mayor Andrew Nosrati.

“The idea of a tax has been kicked down the road. It’s clear with the surrounding communities that it has increased their revenue and it’s also clear that the problem is sustainable revenues. It’s not one-time monies, it’s not cutting more — we’re at a more than 10 percent vacancy rate, we’re cutting customer hours in a growing city. We have a dwindling reserve in a growing city, in a growing business community. I don’t see any other solution that can be implemented as quickly to save this city,” said Council member Nicole Larson.

Larson said that if a tax measure isn’t passed, there’s a very real possibility that Turlock would have to outsource police services and other city department services.

Council member Becky Arellano said that previous councils didn’t take heed of the suggestions offered years ago by a fiscally responsible citizens’ committee and now the City is paying the price.

“It was maybe a lack of understanding of what the ramifications were for not listening to a lot of the business leaders in our community,” she said.

“We really as a Council need to put some fiscally responsible caveats in if we do move forward with an ask because the ask needs to be followed up with responsibility. Just because you put more money into something doesn’t mean it’s going to be spent wisely or spent independently of what could happen or needs to happen. It really depends on who’s sitting up there in the seat. The Mayor has publicly come out and said she hasn’t supported this but she hasn’t given us another plan to move forward on implementing our services that we need to get back up. Our budget that we went through yesterday will include a decrease in police services of (18) positions. This community cannot afford to have (16) less police officers on the streets. It just can’t. I wouldn’t feel good going to bed at night knowing we took (16) police officers off the streets.”

Mayor Amy Bublak said that the public doesn’t trust the Council enough to give it more money to spend.

“We are so far behind, I don’t see how we go forward at this point and tell people ‘trust us’ because if we want to listen to this poll, it said they don’t trust us. So, if we’re going to do this then let’s show the public we’re doing a really good job with our budgets…. Let’s prove to them we are responsible and we are going to make the decisions that are critical to us getting through,” she said.

“People are already hurting with being out work and then we’re going to hit them with a tax. Let’s decide what services the City is going to provide moving forward and create a budget around the revenues it already has. I just don’t think the people have the appetite right now. I don’t think they have the trust of us. Let’s clean up on aisle one first, then look at it differently. Do we need money? Absolutely. But are we doing the right thing with the public’s money right now? Not necessarily,” Bublak continued.

Wells said that as a majority of the City Council was in favor of moving forward with a sales tax measure for the November ballot, he would bring back the item with specific language for the Council to consider at its June 9 meeting.